Title: Understanding Recent Updates to Fraudulent Acts in Criminal Law

Introduction:

Fraud is a serious criminal offense that involves deception or deceit for personal or financial gain. With the constant evolution of society and the emergence of new forms of fraud, it is essential for legal systems to adapt and update the laws surrounding fraudulent acts. This article aims to provide an overview of recent updates to fraudulent act provisions in criminal law, along with some guidance for navigating this complex legal area.

I. Recent Updates to Fraudulent Act Provisions:

In recent years, many jurisdictions have recognized the need to update their laws to address the changing nature of fraudulent activities. These updates may include:

1. Expanding the Definition of Fraudulent Acts:

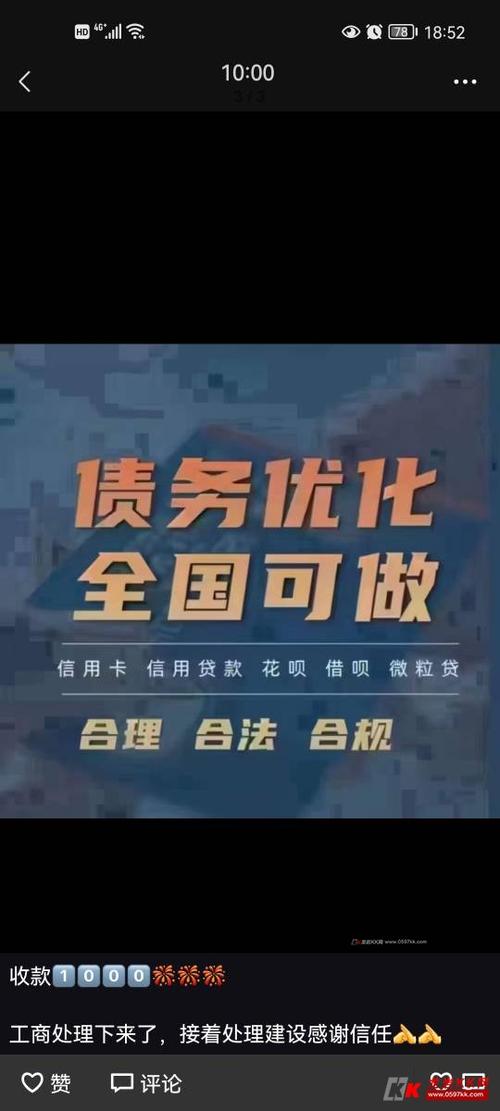

Legislators have broadened the definition of fraudulent acts to cover new methods and technologies used in fraudulent schemes. This includes incorporating internetbased crimes such as identity theft, phishing scams, and online financial fraud into the legal framework.

2. Strengthening Penalties:

To deter potential offenders, lawmakers have increased penalties associated with fraudulent activities. These penalties may include fines, imprisonment, or both, depending on the severity of the offense and the financial harm caused to victims.

3. Enhancing Investigative Tools:

Law enforcement agencies have been granted additional powers to investigate and prosecute fraud. This may include access to financial records, increased surveillance capabilities, or the ability to track and seize assets obtained through fraudulent means.

II. Implications for Individuals and Businesses:

The updated provisions related to fraudulent acts have implications for both individuals and businesses. It is crucial to understand these implications to avoid falling victim to fraud or inadvertently engaging in illegal activities.

1. Individuals:

a. Awareness and Vigilance:

Individuals should stay informed about the latest fraud trends and tactics to protect themselves from becoming victims. This includes being cautious of suspicious emails, phone calls, or requests for personal and financial information.

b. Reporting Suspicious Activities:

If individuals suspect they have been targeted or have witnessed fraudulent activities, they should report them to the appropriate authorities promptly. Timely reporting increases the chances of apprehending the offenders and recovering losses.

2. Businesses:

a. Robust Internal Controls:

Businesses must implement strong internal controls and security measures to prevent fraud within their operations. This may involve regular audits, segregation of duties, and employee education on fraud prevention.

b. Due Diligence in Transactions:

Businesses should conduct thorough due diligence when entering into financial transactions or partnerships to avoid potential fraudulent activities. This includes verifying the identities and credentials of individuals or entities involved and conducting background checks when necessary.

III. Seeking Legal Counsel:

Given the complexity of fraud laws and their frequent updates, seeking legal counsel is highly recommended for individuals or businesses facing fraudrelated issues. Legal professionals specializing in criminal law can provide guidance, ensure compliance with relevant statutes, and represent clients in legal proceedings if necessary.

Conclusion:

The updates to fraudulent act provisions in criminal law reflect the continuous efforts to address the everevolving nature of fraud. It is crucial for individuals and businesses to stay informed about these updates, exercise vigilance, and implement appropriate measures to prevent and combat fraud. By doing so, we can collectively contribute to a safer and more secure society.

Note: This article provides general information and guidance on fraudulent act provisions in criminal law. It is not intended to substitute for professional legal advice.